Are you a policyholder of Life Insurance Corporation of India (LIC)? If yes, then there are chances that LIC may have unclaimed money with you as well. This unclaimed amount can be due to various reasons, such as maturity of the policy, death of the policyholder, or incomplete documents. It is important to investigate any unclaimed amounts to make sure you get the benefits you are entitled to. In this article, we will let you know about how to check unclaimed amount in LIC and how you can withdraw this amount.

LIC is a renowned insurance company in India, serving millions of policyholders across the country. With numerous policies and transactions taking place every day, there can be instances where policyholders fail to claim their entitled amounts. It is crucial to proactively check for any unclaimed amounts to avoid missing out on your rightful benefits.

What is the unclaimed amount in LIC?

Unclaimed amount in LIC refers to the amount which the policyholder fails to claim within a specific period. Which can be due to various reasons, such as not being aware of the amount available to the policyholder, lack of necessary documents, death of the policyholder without claiming the amount by the nominee or legal heir, etc.

Reasons for Unclaimed Amounts

There are several reasons why unclaimed amounts may arise in LIC policies:

- Maturity Benefits: Policyholders might forget or overlook claiming their maturity benefits once their policy reaches its maturity date.

- Death Claims: In the unfortunate event of the policyholder’s demise, the nominee or legal heir may not be aware of the policy or may not have completed the necessary procedures to claim the amount.

- Incomplete Documentation: Sometimes, policyholders fail to provide the required documents or complete the necessary paperwork, resulting in unclaimed amounts.

- Change of Address: If policyholders have changed their address and failed to update it with LIC, the communication regarding the claim may not reach them.

Also Read:- LIC claim process for Odisha train accident

Importance of Checking Unclaimed Amounts

Checking for unclaimed amounts in LIC is essential for the following reasons:

- Financial Security: Unclaimed amounts can significantly impact your financial well-being. By checking for unclaimed amounts, you can secure the funds that rightfully belong to you.

- Family’s Financial Stability: In case of your unfortunate demise, your family may face financial hardships if they are not aware of any unclaimed amounts. Checking for unclaimed amounts ensures your family’s financial stability.

- Timely Updates: Regularly checking for unclaimed amounts allows you to stay updated on the status of your policies and claim any funds that are due to you.

- Avoiding Loss of Benefits: By proactively checking for unclaimed amounts, you can avoid losing out on any benefits or returns on your investments.

How to check unclaimed amount in LIC

Follow the step-by-step procedure given below to check the unclaimed amount in LIC:

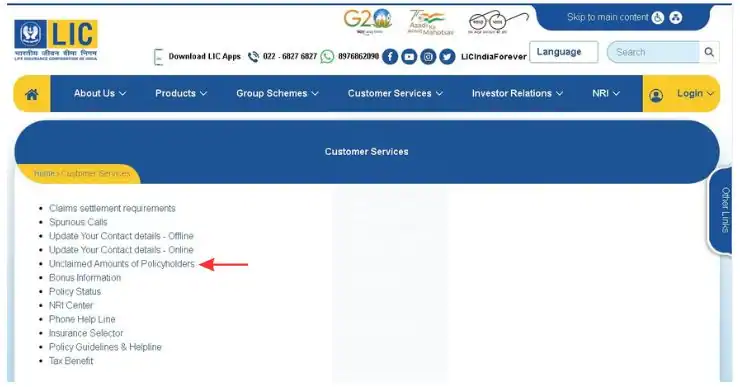

Step 1: First of all, visit the official website of the LIC. To go here, type “www.licindia.in” in your web browser and then go to its official website, or click on this link to reach the website.

Step 2: After this, you will see many options at the top. You have to click on the option with customer service, and here you have to click on Unclaimed Amounts of Policyholders.

Step 3: After that, it will redirect you to another page where you will see a form in which you will have to enter your policy details. For example, you have to enter accurate information, including your policy number, name, date of birth, and PAN card. If you have only the name and date of birth of the policy holder in the policy details, then you can also check your unclaimed amount through this

Step 4: Now submit this information

Step 5: After this, the website will display your outstanding amount in front of you, for which you can claim

Now let’s go ahead and know how to claim an unclaimed amount in LIC.

What to Do If You Find an Unclaimed Amount?

If you find an unclaimed amount associated with your LIC policy, follow these steps to claim it:

Step 1: Contact LIC through their helpline or visit the nearest LIC branch. Inform them about the unclaimed amount you have discovered and your intention to claim it.

Step 2: Gather the Required Documents Gather all the necessary documents to support your claim. This may include the original policy document, identity proof, address proof, and any other relevant document as per LIC’s guidelines.

Step 3: Submit the Claim Application Fill out the claim application form correctly by providing all the required information. Attach supporting documents and submit the claim application to LIC.

Step 4: After submitting the form, you will have to get KYC done, and then after KYC, your claim process will start.

Step 5: Follow up on the claim. After submitting the claim application, keep in touch with LIC to ensure that the process is progressing smoothly. Keep track of any additional documents or information they may need and provide it promptly.

how to Preventing Unclaimed Amounts

To prevent unclaimed amounts in LIC policies, keep the following points in mind

- Stay Informed: Regularly review your policies, stay updated on the claim procedures, and any changes or updates communicated by LIC.

- Maintain Updated Contact Information: Inform LIC promptly about any changes in your contact details, including address, phone number, or email address.

- Nominee and Legal Heir Awareness: Educate your nominee or legal heir about the policies you hold and the necessary steps to claim the amount in case of your demise.

- Timely Documentation: Submit all required documents accurately and within the specified timelines.

Conclusion

Claiming an unclaimed amount in LIC is crucial to ensuring you receive the financial benefits that belong to you. By following the outlined steps and providing the necessary documents, you can successfully claim your unclaimed amount. Regularly check for unclaimed amounts, stay informed about your policies, and update your contact information. By taking these proactive measures, you can safeguard your financial well-being.

Also Read:- Lic claim process for Biporjoy cyclone

FAQs about Unclaimed Amount

Q1: How long does it take to receive the unclaimed amount after claiming it?

The time taken to receive the unclaimed amount may vary depending on various factors. Generally, LIC strives to process claims efficiently and provide the amount to the policyholder within a reasonable timeframe.

Q2: Can someone else claim the unclaimed amount on behalf of the policyholder?

Yes, someone else can claim the unclaimed amount on behalf of the policyholder. However, the person claiming must provide the necessary documentation and fulfill the requirements specified by LIC.

Q3. Is it possible to check for unclaimed amounts in LIC offline?

Yes, you can visit the nearest LIC branch and inquire about any unclaimed amounts associated with your policy. The LIC staff will guide you through the necessary steps.

Q4: What happens if the claim application is rejected by LIC?

If your claim application is rejected by LIC, they will provide you with the reasons for rejection. In such cases, you can review the rejection reasons and reapply with the necessary corrections or additional documents as per LIC’s guidelines.

Q5: Can I claim an unclaimed amount if I am not the policyholder but the nominee or legal heir?

Yes, as a nominee or legal heir, you can claim the unclaimed amount by providing the required documents and following the claim process outlined by LIC.

I know I m the nominee holder, but I dnt have the policy number…what should I do?

If you know the name and date of birth of the policy holder, then fill it and check it.