In today’s era, securing one’s future has become everyone’s first priority. Life Insurance Corporation of India (LIC) is one of the most trusted and reliable options to address this concern. LIC offers a range of options to secure your family’s future and provide financial stability in the event of unfortunate events. One of these is LIC New Bima Kiran Policy 150, which offers comprehensive coverage for your family and attractive benefits.

This article will provide an in-depth understanding of the key features, eligibility criteria, benefits, premiums, and other important details about the LIC New Bima Kiran Policy 150.

LIC Ananda 3.0 Portal Launched: Complete Guide, Features & Ananda 2.0 vs 3.0 Comparison

What is LIC New Bima Kiran Plan 150?

LIC New Bima Kiran Policy 150 is a premium back term assurance policy offered by LIC. This policy is designed to provide financial security to the insured’s family in the event of the policyholder’s untimely death and to provide a return of premiums paid on maturity. The policy offers a mix of insurance and return of premium, making it an ideal option for those who want to secure their future while enjoying financial growth.

Also see: LIC New Jeevan Shree Plan 912 Launched 4, July 2025

LIC New Bima Kiran Policy Details

| Policy Name | New Bima Kiran |

|---|---|

| Table Number | 150 |

| Plan Type | Premium Back Term Assurance Plan |

| Minimum Age Entry | 35 Years |

| Maximum Age Maturity | 60 Years |

| Policy Term | 25 Years |

| Premium Paying Term | 25 Years |

| Premium Payment Modes | Quarterly, Half-Yearly or Yearly |

| Yearly Premium | Rs. 1542/- |

| Sum Assured | Rs. 100,000/- |

| Loyalty additions | Available after 4 Policy Years |

| Death Benefit | Sum Assured + loyalty additions |

| Maturity Benefit | premium return |

| Surrender Value | Available After 3 Years |

Also Read:- LIC Jeevan Kiran Plan 870 Details

Key Features of LIC New Bima Kiran Policy 150

- Policy Term: The policy term for LIC New Bima Kiran Policy 150 is 25 years.

- Premium Paying Term: The premium payment term is also 25 years.

- Minimum Sum Assured: The minimum sum assured under this policy is Rs. 1 lakh.

- Maturity Benefit: If the policyholder survives the policy term, an amount equal to the total amount of premiums paid (including accident benefit premium but excluding other extras) shall be payable.

- Participation in Profits: The policyholder is eligible to receive a share in the profits of the corporation through the policy’s participation in profits.

- Death Benefit: In the unfortunate event of the insured’s death during the policy term, the nominee will receive the death benefit, which is the sum assured along with accrued bonuses.

Eligibility Criteria

To be eligible for the LIC New Bima Kiran Plan 150, individuals must meet the following criteria:

- Age: The minimum age of entry is 35 years, while the maximum age can go up to 60 years, depending on the chosen policy term.

- Policy Term: As mentioned earlier, the policy term can range from 25 years, and the age at maturity should not exceed 60 years.

- Premium Payment Modes: LIC New Bima Kiran policy offers multiple flexible premium payment modes, which include quarterly, half-yearly or annual premiums for the entire term of the policy.

Also see: Top 5 Life Insurance Riders in India 2025

Policy Benefits

The LIC New Bima Kiran Policy 150 offers various benefits to the policyholder and their family. Let’s explore these benefits in detail:

- Death Benefit: In the unfortunate event of the death of the policyholder during the policy term, the death benefit will be paid to the nominee. The death benefit is payable as a lump sum of the Sum Assured or the basic premiums paid till the date of the sum assured plus Loyalty Addition bonuses.

- Maturity Benefit: If the insured survives until the end of the policy term, a maturity benefit is paid, which includes the sum assured along with accrued bonuses.

- Supplementary/Extra Benefits: The plan includes an accident benefit cover that provides coverage for both accidental death and total and permanent disability resulting from an accident up to a maximum of Rs 5,00,000.

Loyalty additions

Loyalty additions: As a with-profits plan, this one shares in the life insurance company’s earnings. It receives a portion of the earnings in the form of loyalty bonuses.

If the policy is in full force, the loyalty enhancements will be paid together with the death benefit or maturity benefits. They are based on the Corporation’s future experience with regard to mortality, interest rates, and future expenses as well as the term and length of the policy.

In the event of death during the first four years of the policy, no loyalty addition will be paid.

Also Read:- LIC Dhan Vriddhi Plan 869 Details

Extended Term Cover

After the term has expired, an extended term cover (without accident benefits) will be offered for a further 10-year period on the following scale.

| Policy Term | Extended Death cover |

|---|---|

| 10 – 14 years | 20% of Sum Assured |

| 15 – 19 years | 30% of Sum Assured |

| 20 – 24 years | 40% of Sum Assured |

| 25 – 29 years | 50% of Sum Assured |

| 30 years | 60% of Sum Assured |

Surrender Value

The LIC New Bima Kiran Policy 150 gets a surrender value after premiums have been paid for at least three complete years. The surrender value is a percentage of the total premiums paid, excluding the first year’s premium. The policyholder can surrender the policy, if required, and get the surrender value.

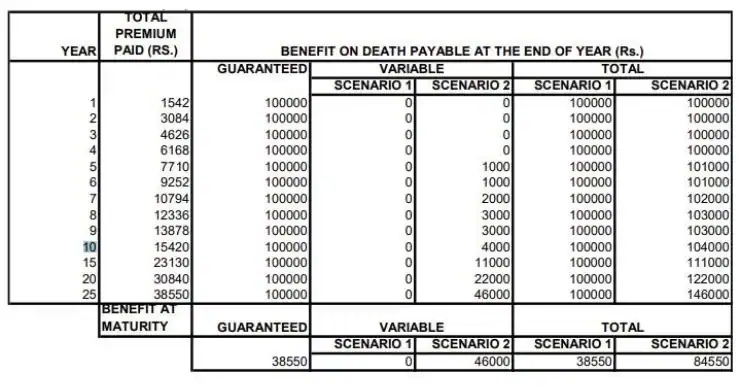

Benefit Illustration

Conclusion

The LIC New Bima Kiran Plan 150 is a comprehensive term assurance policy that provides financial protection and premium back benefits. With its flexible premium payment options, attractive policy benefits, and reputation, LIC offers individuals a reliable way to secure their financial future. By considering the eligibility criteria, policy features, and exclusions, individuals can make an informed decision and choose a policy that aligns with their goals and requirements.

FAQs about LIC New Bima Kiran Policy

Q1: Can I change the policy term and premium payment term after purchasing the policy?

No, the policy term and premium payment term cannot be changed once the policy is purchased.

Q2: Is the death benefit taxable?

No, the death benefit received under LIC New Bima Kiran Plan 150 is tax-free under Section 10(10D) of the Income Tax Act, 1961.

Q3: Is the death benefit paid only in the case of natural death, or does it cover accidental death as well?

The death benefit is payable in the case of both natural and accidental death during the policy term. The nominee will receive the sum assured along with any applicable accrued bonuses.

Q4: What happens if I miss paying my premium on time?

If you miss paying your premium on time, a grace period of 30 days (15 days for monthly premium payment mode) will be provided. If the premium is not paid within the grace period, the policy will lapse, and no benefits will be payable.

Q5: Can I surrender the policy before the maturity period ends?

Yes, you can surrender the policy before the maturity period ends. The surrender value will be paid based on the terms and conditions specified by LIC.